On the other hand, businesses that require a lot of physical assets, like airlines and automakers, will have a high level of fixed assets. As a result, we can also conclude that fixed costs do not affect production choices. When you run your own business, you’ll have to cover both fixed and variable costs.

- The direct labor would be the salaries of the workers who cut the wood, assemble the pieces and then paint the dog house.

- If the company sells 1,000 refrigerators, it spreads the fixed cost of the lease over more refrigerators.

- Production capacity is a critical concept for business managers to stay focused on.

- The proportion of fixed to variable costs (and how they’re allocated) can depend on its industry.

Fixed Costs

For some businesses, overhead may make up 90% of monthly expenses, and variable 10%. The key takeaway of this case study is that understanding the fluctuations in manufacturing costs can empower companies to make informed and timely choices between outsourcing and in-house production. These informed decisions help in maximizing productivity and profitability. By calculating manufacturing costs, companies can clearly understand the true cost of making a product.

Fixed Cost vs. Variable Cost

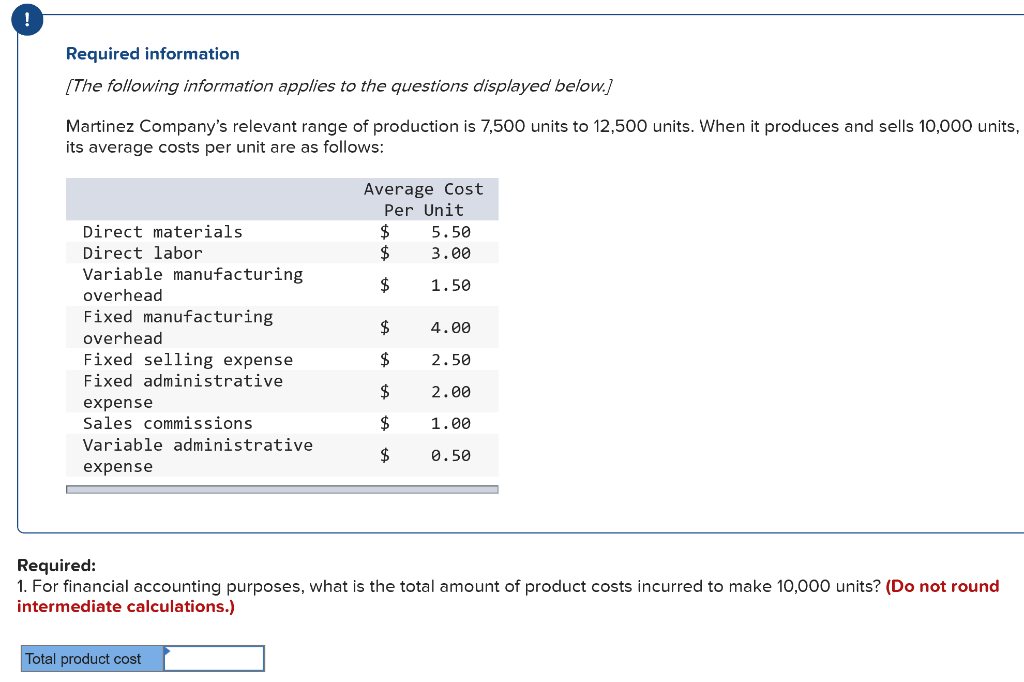

The three main components of manufacturing costs are direct materials, direct labor, and manufacturing overhead. This concept suggests that as production volumes increase, the cost per unit of production tends to decrease. This reduction occurs because fixed costs (such as machinery and overhead expenses) are spread over a larger number of units. Consequently, larger production runs often lead to lower per-unit costs. Businesses can leverage economies of scale by maximizing production capacity and optimizing resource utilization. Absorption costing is a costing system that is used in valuing inventory.

What is the difference between fixed cost and total cost?

Advancements in technology have revolutionized manufacturing processes across industries. Adopting modern technologies such as automation, robotics, and advanced manufacturing techniques can streamline operations, improve efficiency, and reduce labor costs. For instance, automated assembly lines can increase production speed and accuracy while minimizing labor-intensive tasks, thereby lowering overall manufacturing expenses. The effective use of fixed costs can improve efficiency and allocate resources essential to success.

By the end of this guide, you should have a solid understanding of the various elements that contribute to manufacturing costs and how to analyze them effectively. Whether you’re looking to optimize current operations or are in the planning stages of setting up a manufacturing facility, the insights provided here will be invaluable. fixed manufacturing costs For example, manufacturing aluminum generates quite a lot of carbon dioxide per weight of product, while making the same amount of brick generates much less. But the tonnage of bricks produced every year is far higher than that of aluminum, so making bricks contributes more to climate costs overall than making aluminum.

Fixed vs Variable Costs (with Industry Examples)

For the company to be profitable, the revenue it makes must be more than the total expenses for its manufacturing costs and production costs combined. All fixed manufacturing costs are combined at the end of the monthly accounting cycle. You count the beverage units you produced over the same period on the same day. The remaining fixed manufacturing costs are then divided equally among the beverage units. They are not costs incurred directly by the production process, such as parts needed for assembly, but they nonetheless factor into total production costs. To produce a product or service, the business has to be functioning and operational, and fixed costs represent those necessary operating costs.

The objective is to identify variances, which are the differences between actual and budgeted costs, and to determine the reasons behind these variances. For instance, someone who starts a new business would likely begin with fixed expenses for rent and management salaries. Accounting for these costs in market prices could encourage progress toward climate-friendly alternatives. It is required in preparing reports for financial statements and stock valuation purposes. The COGM is then transferred to the finished goods inventory account and used in calculating the Cost of Goods Sold (COGS) on the income statement.

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Take your learning and productivity to the next level with our Premium Templates. Steel and plastics have the highest overall contribution due to the very large demand for these materials. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.

Recent Comments