In addition, consider a technology manufacturing company that shelves units that may not operate as efficiently with age. For example, a company that sells seafood products would not realistically use their newly-acquired inventory first in selling and shipping their products. In other words, the seafood company would never leave their oldest inventory sitting idle since the food could spoil, leading to losses. Determine the cost of the oldest inventory from that period and multiply that cost by the amount of inventory sold during the period. Now, let’s assume that the store becomes more confident in the popularity of these shirts from the sales at other stores and decides, right before its grand opening, to purchase an additional 50 shirts.

How Does the FIFO Method Work?

More expensive inventory items are usually sold under LIFO so the more expensive inventory items are kept as inventory on the balance sheet under FIFO. Not only is net income often higher under FIFO but inventory is often larger as well. The inventory is not something that most investors care about as it’s the gross profit margin that indicates the performance and efficiency of a business. The gross profit margin is the ratio of gross profit to the net total sales and the higher the number is, the more successful a business is in generating profit. In order to track stock using the FIFO method, businesses must maintain detailed records of each item’s entry and exit date. However, almost all warehouses today utilize some kind of warehouse management system (WMS) or inventory management software (IMS) to accomplish this task.

What Is Inventory?

This method is FIFO flipped around, assuming that the last inventory purchased is the first to be sold. LIFO is a different valuation method that is only legally used by U.S.-based businesses. The company sells an additional 50 items with this remaining inventory of 140 units. The cost of goods sold for 40 of the items is $10 and the entire first order of 100 units has been fully sold. The other 10 units that are sold have a cost of $15 each and the remaining 90 units in inventory are valued at $15 each or the most recent price paid. For example, in the pharmaceutical industry, where drugs and medications have expiration dates, the FIFO method is critical to compliance with regulatory requirements.

- When calculating your ending inventory value using FIFO, you’re reporting on the regular flow of inventory throughout your supply chain.

- FIFO serves as both an accurate and easy way of calculating ending inventory value as well as a proper way to manage your inventory to save money and benefit your customers.

- While other sequences need additional information on the sequence (i.e., “Which part is next?”), FIFO automatically includes this information.

- Utilizing the FIFO method also helps businesses to accurately calculate their COGS and inventory valuation.

FIFO Inventory Method

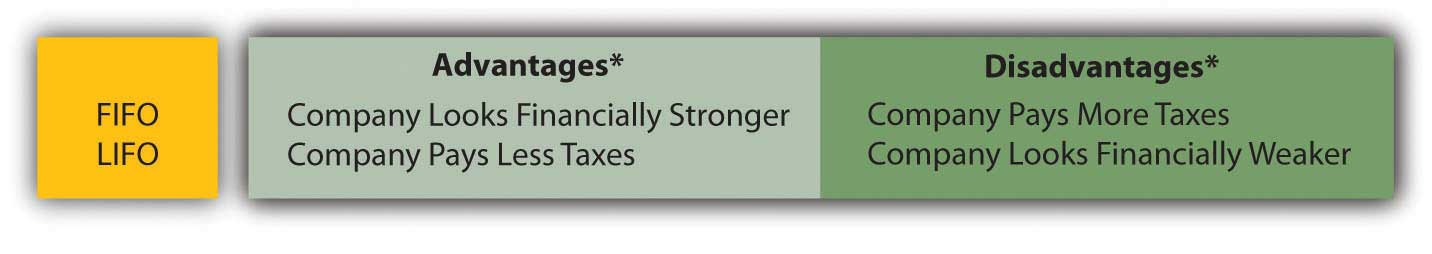

In addition to being allowable by both IFRS and GAAP users, the FIFO inventory method may require greater consideration when selecting an inventory method. Companies that undergo long periods of inactivity or accumulation of inventory will find themselves needing to pull historical records to determine the cost of goods sold. The valuation method that a company uses can vary across different industries. Below are some of the differences between LIFO and FIFO when considering the valuation of inventory and its impact on COGS and profits. The Last-In, First-Out (LIFO) method assumes that the last or moreunit to arrive in inventory is sold first.

Major Differences – LIFO and FIFO (During Inflationary Periods)

Assume a company purchased 100 items for $10 each and then purchased 100 more items for $15 each. The COGS for each of the 60 items is $10/unit under the FIFO method because the first goods purchased are the first goods sold. Of the 140 remaining items in inventory, the value of 40 items is $10/unit and the value of 100 items is $15/unit because the inventory is assigned is it time to switch to paying quarterly taxes the most recent cost under the FIFO method. If there was no inflation, the order of items sold wouldn’t matter but since realistically the prices tend to go up, using one method over the other affects your income statements and taxes. It’s an inventory accounting method that assumes that the first goods produced or manufactured are also the first ones to be sold.

Many business require obsolete inventory to be written off against its bottom line after a predetermined period of time has lapsed since its last usage. FIFO helps prevent obsolete inventory by using the inventory first received before using newer inventory. The FIFO inventory method refers to the timing at which inventory is purchased and subsequently used. Inventory that is purchased first is sold or used in production before inventory that is purchased at a later date. The key term here is interpretation, as these methods are used for reports and the inventory amount is an estimate, not an exact value.

There is also the risk that older inventory items will get damaged or become obsolete. A key benefit of the LIFO method of accounting for inventory is that it helps to mitigate rising inventory costs. Profits under LIFO are more appealing to investors during periods of economic reductions in pricing. From a production perspective, you sell the first batch brewed within the period before selling a subsequent batch. Sales at your cellar door would then use up your brewery stock with the oldest expiry date, followed by sales of inventory based on sequential expiry dates. You can save money managing your inventory using the FIFO method, which ensures more accurate financial reporting and is beneficial to your customers.

This ensures that the first batches you brew are the first batches you sell. First-in, first-out takes the inventory purchased first, and sells these most recent purchases chronologically in the order of acquisition. The FIFO method is more globally accepted and better for limited-life goods vs LIFO inventory valuation. No, the LIFO inventory method is not permitted under International Financial Reporting Standards (IFRS). Both the LIFO and FIFO methods are permitted under Generally Accepted Accounting Principles (GAAP).

It’s an estimate that is calculated by a variety of methods, each resulting in a different number. So, LIFO and FIFO do not reflect what has actually happened in a company’s bank account, rather, it’s just how they are reporting it. In addition, there are other factors to consider when deciding between FIFO and LIFO.

Recent Comments